Contents:

The importance of having a demo account can’t be overlooked as this gives you a chance to test drive the platform without risking any capital. You can choose from two ways to create a free account at the online broker. On their website, they have a detailed page listing how they are regulated and what countries they are covered in. Also, they clearly state which countries are unable to open an account with Binary.com. From how it appears, this company does a solid job of divulging as much detail as possible to ensure their investors and traders are informed. Binary options are built off the premise of a defined risk product.

Which is the best binary broker?

- Pocket Option – Best Binary Options Broker Overall. Pocket Option is our top pick as the best binary options brokerage.

- Expert Option. Expert Option is a binary options exchange that offers 100+ binary options.

- Nadex.

- Olymp Trade.

- Binary.com.

- Binarycent.

- RaceOption.

- Binomo.

Binary.com is licensed and regulated as a Category 3 Investment Services provider by the Malta Financial Services Authority (licence no. IS/70156). This company has been offering its trading platform all over the world since 1999 and is providing services to over 300,000 clients. In addition to spot FX trading, Binary.com is a prominent binary option broker with a large variety of option types on currencies. The products offered on the Binary.com website include binary options, contracts for difference (“CFDs”) and other complex derivatives.

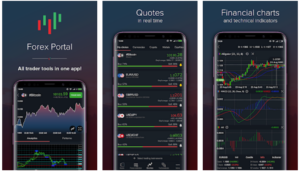

Mobile Trading

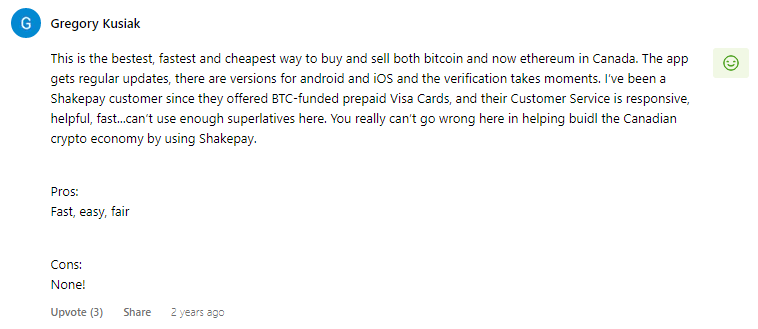

When i send reference numbers they just simply told me all are good trades they can’t reimburse. Binary.com now known as deriv for a reason I can’t say is the most heartless broker and Fraud ever. Thank you for posting a review and we’re sorry to hear that your experience was not up to standards. We would like to assure you that we have been operating for over 20 years, during this time we have always been licensed and controlled by several regulators.

Binary Options Trading 2023: Free Guides – Investing – Biz Report

Binary Options Trading 2023: Free Guides – Investing.

Posted: Sun, 19 Feb 2023 08:00:00 GMT [source]

Your other market instruments consist of Commodity markets which offer different asset opportunities for traders. Investing in contract-based tradable goods is a dependable way to alleviate risk during times of inflation or economic uncertainty. Forex brokers can also provide services to not just individual traders, but also provide for institutional clients and large businesses, for example, investment banks.

Trading Platforms

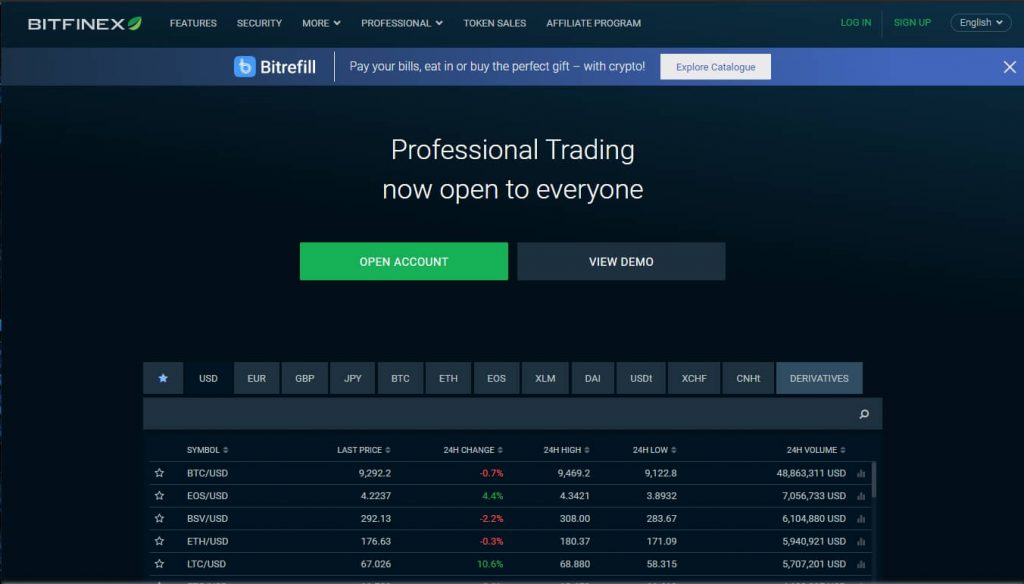

You can also trade 7 types of Market Volatility Indices and Cryptocurrencies, including Bitcoin, Ethereum, and Litecoin. This broker also offers CFDs which are available through its Metatrader platform. This also allows you to trade assets with leverage effects, such as Forex currency pairs and different CFDs contracts on stocks and commodities. BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups.

- MetaTrader 5is the most popular software worldwide for online trading.

- It is one of the leading platforms for trading binary options.

- No matter what random trade I put on I would constantly lose money.

- When you are only learning to trade, many requirements can frustrate you.

- The customer base that trades with mobile devices is rising continuously.

Remember that, in either case, your information and data remains completely safe as the platform is encrypted with modern encryption standards. The ECB will consider ways to transfer interbank payments to the blockchain … Deposits are instant while withdrawals generally are processed within one working day. Deposits are instantly processed while withdrawals take one working day. The company has been honored with many awards that testify to its high status in the industry.

As a brokerage service provider, Binary.com specializes in exclusive technology related to binary options trading. This means it has some of the most reliable binary options signal generations that work in real-time to provide users with unique data. The Binary Bot is a programming tool that allows you to create your own auto-trader.

Binary. Com & MT5 is a scam broker.

Would love to know if there’s anyone else out there that offers this to spread the risk. I traded their random markets for over a year and was doing very well. Then when the company changed hands, suddenly everything changed.

It is because of the fact that most other live binary options trading service provider firms demand a minimum deposit of $250 or $500 for opening an trading account. It allows this trading platform to become more accessible to people from all backgrounds. However, remember that the company does not offer any joining or deposit bonus at present.

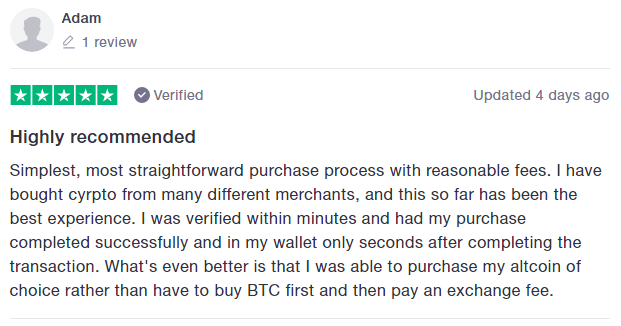

While our partners compensate us for our work, they can not alter our review process, ratings, and recommendations. Using multiple binary options brokers might be a wise move as you decide which platform fits your needs. Return rates at Binary.com can go over 100% on up/down positions and over 1000% on touch/no-touch and high/low trades. They have over 100 CFDs, and their tradeable assets include commodities, indices, cryptocurrencies, forex, metals, and forex. Honestly, it is one of the most reputable binary options brokers in the industry.

However, the Binary.com MT5 trading account allows users to access features such as limit orders. It has features like stop loss, advanced charting, and one-click trading. Any trader can make risk-free traders from a demo account as there is no involvement of money.

Featured Broker

Definitely recommended for any beginner and even advanced traders to take a look. Minimum deposits range from just $5 up to $100 depending on the method chosen, and maximum deposits range from $200 up to $100,000. The minimum withdrawal amount ranges from just $5 up to $100 depending on the method chosen,and maximum withdrawals range from $200 to $100,000.

The trader has to predict if the price will finish within or outside this range. As mentioned above, it is evident that the critical feature of Binary.com is the fact that you can open an account with only $5. Unlike many brokers, there isn’t a menu of accounts to choose from, there are just Virtual and Real accounts. With offices in Malta, Malaysia and Japan, the company now has over 1 million registered accounts worldwide and handles approximately 15 transactions per second.

Aside from being able to generate different types of charts, traders can also select various ways to display them, including legacy, pop-up and interactive charts. The Binary Group is regulated and licensed in the UK, Malta, Japan and the Isle of Man. To ensure the security of its clients’ review broker binary.com funds, they are kept in segregated accounts with licensed financial institutions. Binary.com offers some of the best return rates for classic Up/Down trading in all market conditions. Return rates can range from 65% to 88%, but the average return rate is somewhere at around 75%.

This extends to serving customers with transparency and honesty, communicating using easy-to-understand plain language, and settling contracts by the book. Today, it has more than 200 contractors and staff members around the world, as well as more than a million registered accounts. With CFDs, the trade size can increase or decrease based on variable leverage. Payouts – The industry standard for payouts is from %50 – %100. Before you start trading, make sure you know how much your payout is. While not usual, some offer a payout structure as high as %200.

Deriv MT5 Synthetic Account Review – How To Setup DMT5 Account

Funding your real trading account with the broker is also smooth as it requires only a few steps. Ideally, a novice trader can learn to trade on a Binary.com demo account before he places his trade on his standard account. A trader can choose an account type based on his expertise.

Trading CFDs on leverage involves significant risk of loss to your capital. Age of a binary broker – Find companies with a proven record over a few years. Brokers that have been in business for several years have proven their reputation.

As one of the more established binary options brokers, Binary.com wasn’t always known by this name. The rebrand was undertaken to capitalise and increase their share of a growing binary options market. Furthermore, a demo account will allow you to practice trading strategies with virtual money. Depending on your trading experience and preferences, choose an account type. Therefore, we designed this review to give you a comprehensive overview of the broker platform, asset types, deposit and withdrawal methods, and other features. There are numerous choices when it comes to payment methods linked to this company.

Is binary com a trusted broker?

Binary.com is a licensed and regulated trading platform that serves over 1,000,000 customers globally. We hold multiple licenses to comply with regulations around the world. Since 1999, we've served our clients with a constant and unwavering commitment to integrity and reliability.

There are currently over 1million registered users trading on this platform, with up to 20 trades being processed every second. However, the online trading platform is not as feature-rich as it should be. This broker lags in providing features of copy trading, social trading, education, and research to the traders. In addition, features such as stop loss and limit orders are also missing from Binary.com.

What happened to binary com?

You can no longer trade digital options on any of our platforms. You also can't deposit funds into your Options Account. Any open positions on digital options have been closed with full payout. Please proceed to withdraw all your funds from your Options Account before 30 November 2021.

Among the types of binary options, you can trade those for forex, indexes, commodities, and volatility indices. MT5 is an innovative online trading platform useful for traders wishing to step into the world of different financial markets. Binary.com allows you to try out a range of innovative strategies to maximize your chances of winning. To start, there is a unique method to select expiry time. Plus, the trading platform offers flexibility in choosing expiry and contracts. For these reasons, this broker is recommended for advanced traders.

I’m a crypto trader and I got into the scene when crypto volatility was really high. Due to poor judgement, I lost a couple of hundred to amateurs who promised to help me grow my funds on their https://forexarena.net/ crypto investment platform. It took ‘Recovercoin AT rescueteam DOT com’ over 72 hours to trace and recover my money back. Expiries range from 5 ticks to one year and are very flexible .

Is binary option real or fake?

While binary options may be used in theoretical asset pricing, they are prone to fraud in their applications and hence banned by regulators in many jurisdictions as a form of gambling. Many binary option outlets have been exposed as fraudulent.